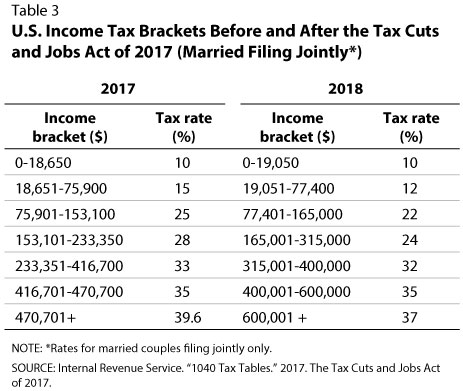

Statutory, Average, and Effective Marginal Tax Rates in the Federal Individual Income Tax: Background and Analysis - EveryCRSReport.com

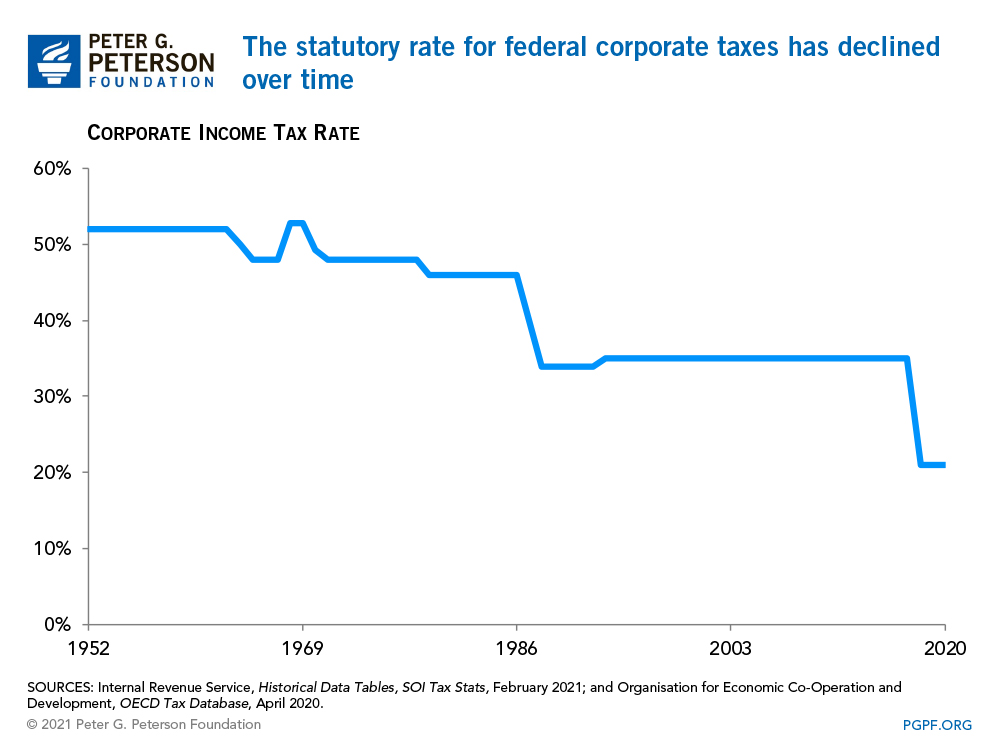

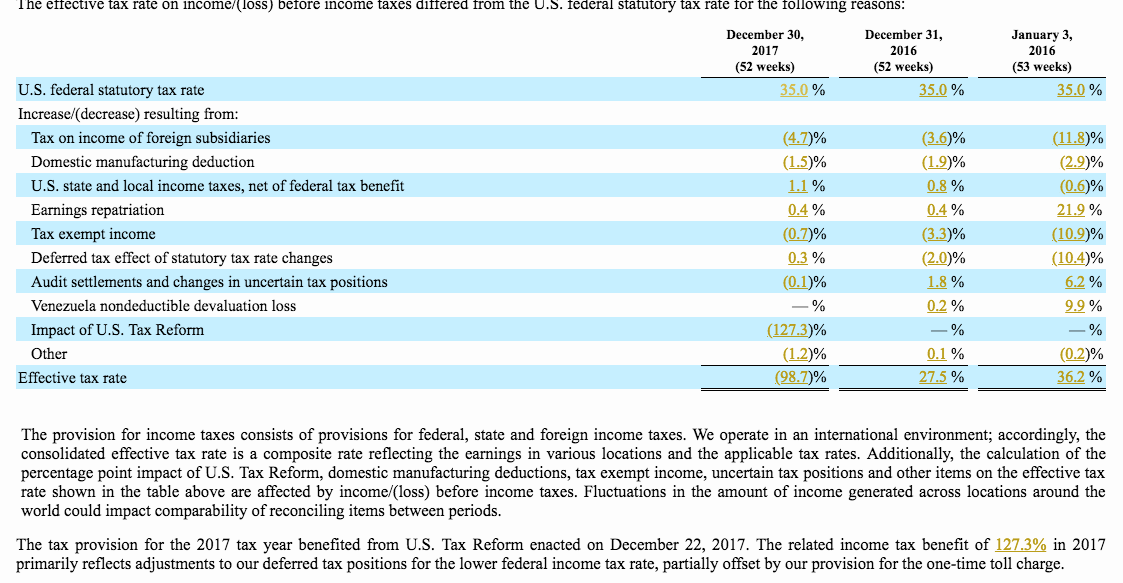

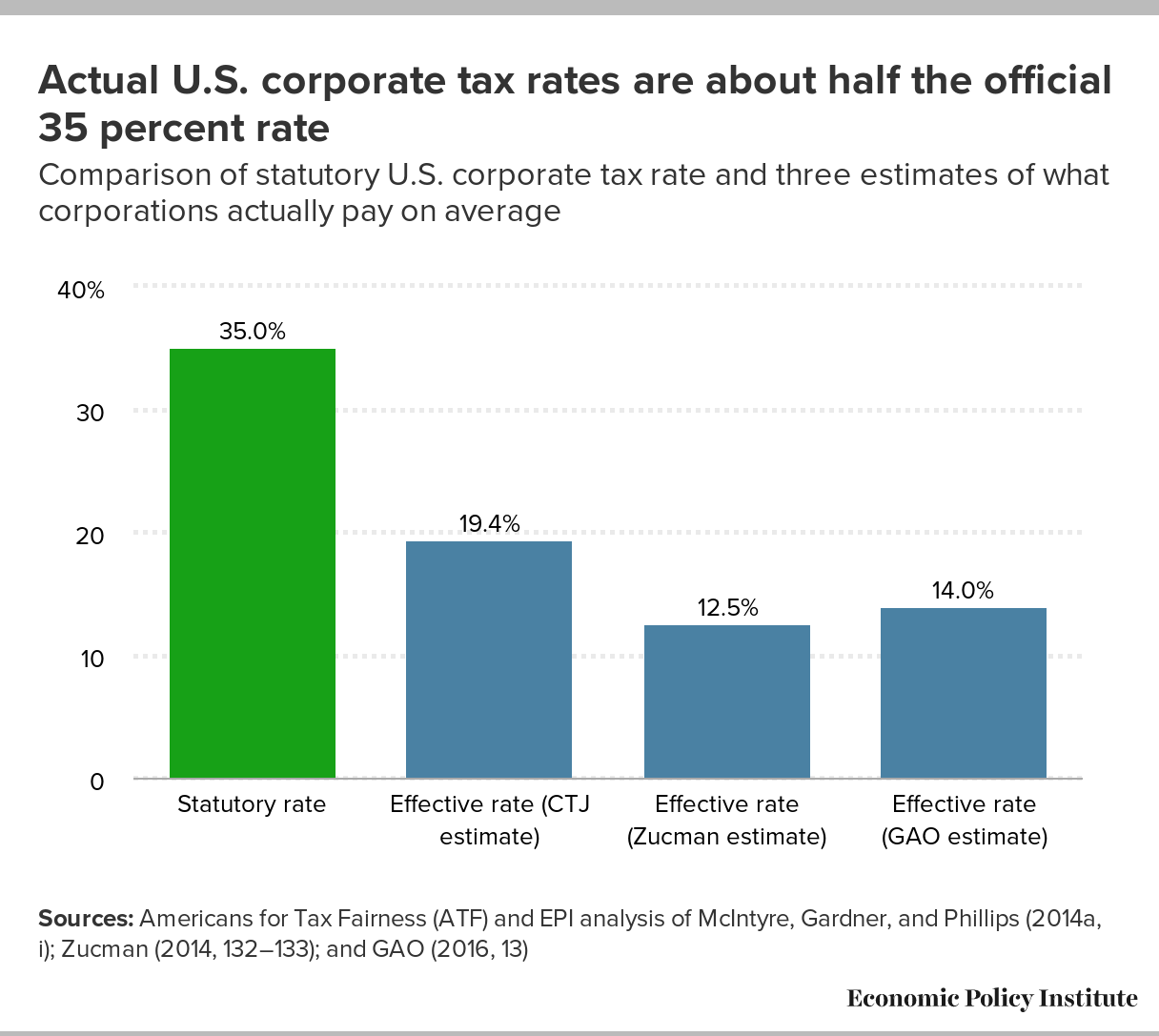

Corporations pay between 13 and 19 percent in federal taxes—far less than the 35 percent statutory tax rate | Economic Policy Institute